Thank you for your support of the Mississippi Gulf Coast Community College Annual Scholarship Gala commemorating the 50th Anniversary of the MGCCC Foundation.

This year’s Gala raised over $2 million to support student success.

Annual Scholarship Gala

MARCH 9, 2024

Gala Video

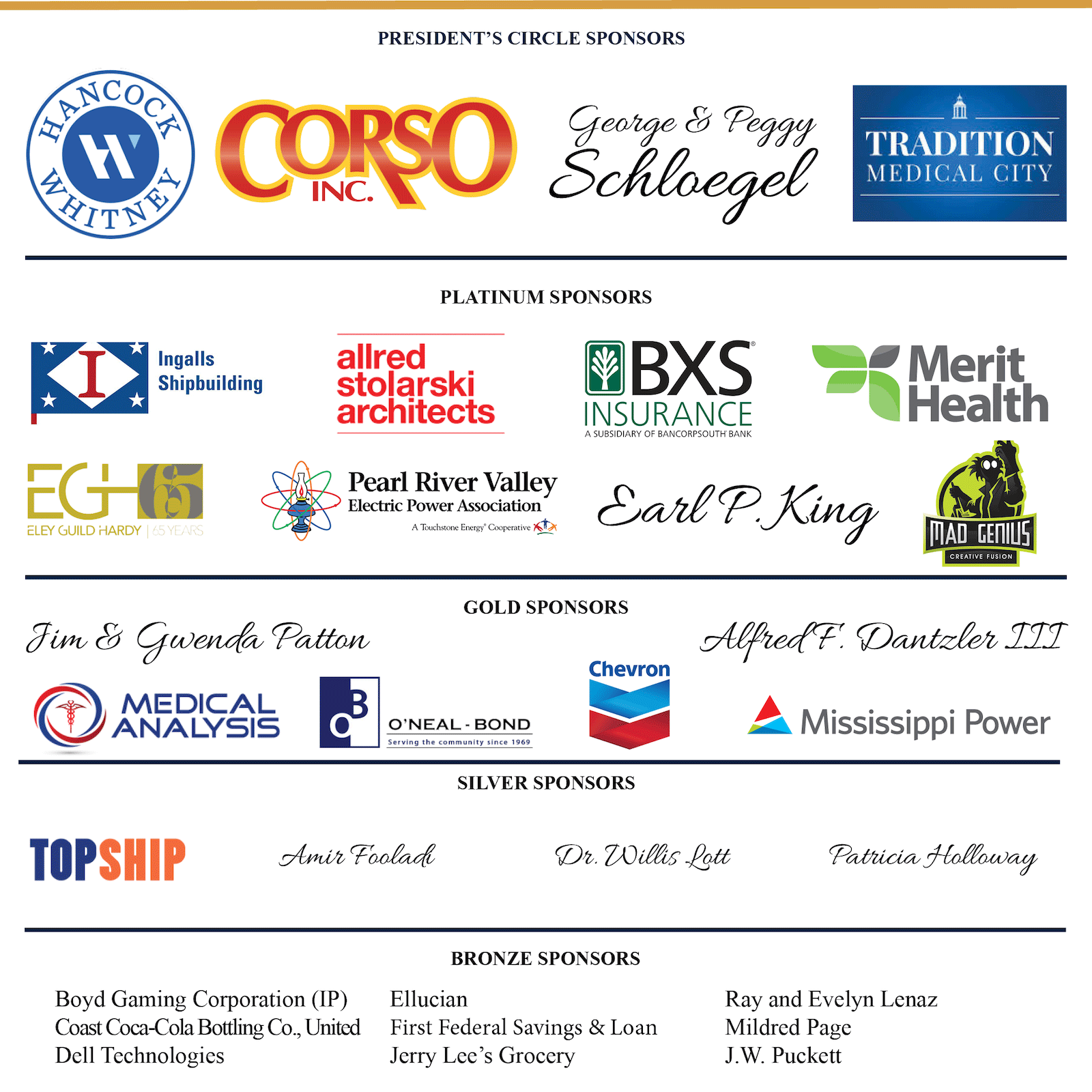

Sponsors

| President's Circle | $50,000 |

| Platinum | $25,000 |

| Gold | $12,500 |

| Silver | $6,000 |

| Bronze | $2,500 |

| Couple's Ticket | $175 |

| Individual Ticket | $100 |

Silent Auction Donors

Ways to Give

Direct Scholarship Donations

Provide a direct donation to the MGCCC Student Success Scholarship Fund

Become a Foundation Member

A minimum investment of $250, with an option to pay over a five-year period, entitles you to become a member of the Foundation.

Memorials

Make a contribution to the MGCCC Foundation in memory of a friend or relative in lieu of floral tributes.

Jazz Band Scholarship

Make a direct donation to support students in the jazz band.

Bequests, Trust Agreements and Investment Securities

Bequests allow you to memorialize a loved one by establishing, through your will, a scholarship in his or her name. A part of your estate or a particular piece of property may be invested in this way. Trusts of many types may be worked out. Your attorney is the best person to advise you on the kind of trust to establish and the tax advantages. Stocks and bonds held for more than six months may be the easiest and most advantageous way to invest. If the securities have gained in value, you can avoid the capital gains tax and also claim a deduction for the fair market value. If the securities have depreciated, you may sell them and invest the proceeds, since you can take a tax loss on the drop in value and also deduct the proceeds as a charitable contribution.Contact Us

Dr. Suzi Brown

Executive Vice President of Institutional Advancement

suzana.brown@mgccc.edu

(601) 528-8480

Paige Cannon

Scholarship and Programs Specialist

paige.cannon@mgccc.edu

(601) 528-8446

Past Galas in Review

Watch the 2020 Virtual Gala

The Annual Scholarship Gala is the Foundation’s primary fundraiser. Gala donations go directly toward scholarships that help provide a quality education to many deserving students. We were disappointed that we had to cancel our in-person Gala, previously scheduled for May 1, 2020. We are, however, thrilled to announce our first ever Virtual Gala, which will stream on August 4th! With so many people affected by the pandemic, scholarships are more important now than ever before. We want to ensure that students are able to enroll this fall and pursue their educational goals.

On behalf of the MGCCC Board of Trustees, Dr. Mary Graham and the Executive Council, the Foundation board of directors, our incredible students, alumni, all Gulf Coast faculty, staff, and friends… THANK YOU for your continued support. We simply couldn’t do it without you.

your Donation to the 10th Annual Scholarship GalaDonate

| President's Circle | $50,000 |

| Platinum | $25,000 |

| Gold | $10,000 |

| Silver | $5,000 |

| Bronze | $2,000 |

Thank you to our generous sponsors

Contact Us

P.O. Box 99

Perkinston, MS 39573

The Mississippi Gulf Coast Community College Foundation held its annual Scholarship Gala on May 20 at the Beau Rivage Resort and Casino in Biloxi. The annual event raised over $1,000,000 for MGCCC student scholarships.

At the gala, Joseph C. Canizaro was named recipient of the 2019 Hornsby Award. The Hornsby Award, named after MGCCC alumnae Claire Sekul Hornsby, is given annually to a leader, trailblazer and outstanding supporter of the college.

Funds raised during the gala provide scholarships through the MGCCC Foundation for students who need financial assistance. MGCCC provides many scholarships annually to ensure students are able to reach their educational goals.

Thanks to our 2019 Sponsors

View More 2019 Gala Photos